I have officially been a salaried employee for 11 months!

And while my future salaries are in question due to some administrative foolishness, I am proud to say that I’ve been reasonably responsible with the last eleven paycheques I’ve received.

WELCOME TO THE 21st CENTURY…

I usually sort through my finances in the first week of the month and then spend the rest of that month on autopilot. The 22seven app helps me with this by categorizing things according to my spending plan and then tracking how my money moves as I go.* I used to track everything manually, but I found that wasn’t good for me as I became obsessive and micromanaged my spending to the point where my relationship with money became a little toxic. Using the app still keeps me accountable and I always know exactly where I am on any given month, plus I can easily compare or look back at previous months’ spending in, for example, the “Exceptions” categories and decide if I want to change anything or simply plan better for the coming year.

That being said, a big part of what made ‘manual’ tracking difficult for me was that I did everything on a Word document. Yes, a Word document. This meant hours spent calculating and double checking everything because I didn’t have the brilliance of Excel formulas to prepopulate fields!

Why was I torturing myself like this? Well, as much as I appreciated my schooling days, I didn’t go to schools that encouraged computer literacy all that much. I was one of the fortunate few who had access to computers at home for parts of growing up, so I taught myself the things I needed to know to navigate using computers for entertainment and school projects. Sadly, Excel rarely was necessary. The small bits of computer ed we did learn prior to subject selection in Grade 9 (where you could opt out to pick subjects necessary for your planned University applications) were no more advanced than what I’d managed to learn autodidactically, and then the quick Excel exposure we had in University was sprinkled into a poorly presented module that most of us hated (Biostats) and therefore simply rushed through to pass the course, retaining zero information long term.

This year I did come out of the dark ages, though, and although I am nowhere near a spreadsheet ninja like most people who track their finances, I’ve managed to be comfortable with some very basic functions thanks to the wonder of the internet. This has been useful above using an online app because I actually see my specific categories and certain metrics as proportions of others, which made me realise that even months and categories that I felt were expensive or overbudget weren’t, whereas ones that I’d been comfortably coasting were quite far above their expected levels. Yay for learning how to let the computer do my maths for me!

So, now that I’ve got that dirty little secret out, I think it’s time to painstakingly analyse my year so far. I have a few big goals for next year, but I think it would be good to touch base with regards to some of the goals I’ve shared on here before and how close (or far!) I am from reaching them. I also want to air out some of the obstacles and fears I have when it comes to some things that other more financially secure people might take for granted.

SO WITHOUT FURTHER ADO…

- I committed to getting into the habit of saving from day one.

This was a rather nonspecific goal but I’m really glad I set it. By paying myself first (technically third, but whatever) each month from the very beginning, I never became accustomed to a lifestyle that required my entire paycheck to sustain it. This has given me incredible flexibility, allowing me to reach the rest of my goals as well as giving me the confidence that I’ll be able to reach my goals for next year as well since purple (or is it green in this case?) is already a habit 😉 . (That’s a hip hop reference for those hearing crickets. Hip hop meets personal finance wha-whaaaat!)Ahem.

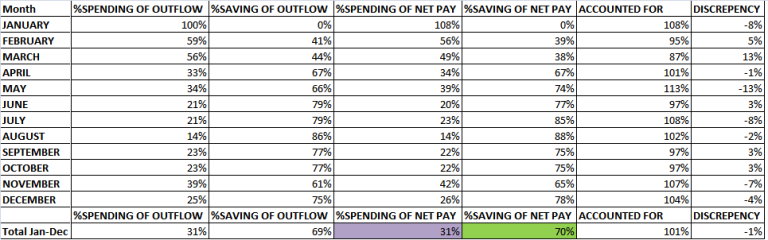

Here’s an excerpt from my spreadsheet:

Oh, these 1%-ers… So, just so the numbers make sense, I have to clarify that my calculations are off by 1% because of some rounding that happened in some other parts of the spreadsheet.

Also, there is a snag because technically I didn’t really fulfill this goal from “day one”. If you sneak a peak at January, I spent 8% more throughout that month than what I got “paid”. This is because I didn’t get paid until the very end of January, and for spending and savings I prefer to use money that I actually have as opposed to money I expect in my tracking calculations (I do things slightly differently where tax-years are relevant to calculations, like figuring out my approximate tax return for RA contributions because obviously SARS cares more about technicalities than practicalities.) So in January, I spent R2744 on all my expenses related to moving for work and surviving for that month. I only got “paid” R2550 (the sum of cash gifts received from relatives throughout that month of brokeness). The surplus was from money I already had in my bank account from the previous year (minimal) and gift cards that I received as graduation gifts. Needless to say, January was a tough month and I didn’t save a cent until I got my paycheck at the very end, which I classified as February’s income for the sake of consistency (I won’t have to do this next year, I reckon.)

A last point is that you can see that “December” is already populated in the above table. Elsewhere in my spreadsheet, I colour coded the values I used because they are estimates/projections of what I should earn this month and what I expect to spend. It hardly matters because I already automated the planned savings, but I overbudgeted my “exceptions” category deliberately just in case.

Overall though, I’m really proud of myself. I may not be able to stay at this savings rate in 2017 (I have a family project planned, as well as needing to buy a few major appliances for when I move to work at our sister hospital and then moving costs at the end of the year for my ComServe post) but it was a good run nevertheless.

Nothing to cry over for this goal. (Also, this picture is kinda wasteful.) - I committed to getting out of debt.

I already celebrated this milestone (and linked to it earlier), but I also had the honor of being featured in Natalija from Frugal in SA‘s series on being debt free. Head on over and give that a quick read if you haven’t already. Getting out of debt was a huge deal for me, and relieved me of a lot of financial stress that has been plaguing me for years. I don’t plan to ever be in that position again, although everyone says I’ll change my mind once I start hankering for a car (hm…we’ll see) and house!

Paying back my debt accounted for a significant portion of my savings and was the major reason I didn’t save up for a car or invest after-tax money. I have no regrets with that decision, especially since that money is now available for my other goals.

Nothing to cry over for this goal. - I committed to maxing out the SARS Retirement Allowance.

This one was difficult. I obviously want to break the cycle and not be dependent on my children for retirement, and I want compound interest to be on my side. But you can only touch tax-deferred retirement accounts without being haevily penalised at age 55, which is a little later than I plan to officially “retire” so one could argue that I should take the tax hit now so that my money will be available when I need it. Now, I don’t want the tax tail to wag the investment dog, but my tax rate is ridiculous and while I’m not anti-social services I’m happy contributing what I have to and not a cent more. RA’s are a great way to get back some of that money in one fell swoop so you’re not tempted to do anything stupid with it over the twelve months government is borrowing it from you. I didn’t contribute anything to retirement savings while I was paying off my debt, so when I finally had that money available to snowball the mountain was so steep I nearly cried. I set up a debit order for my RA and then calculated how much I needed to save up to make up for lost time in a lump sum. When I finally had that amount saved up, I was so afraid to invest it via my RA because I felt like maybe I should rather be looking to get a cheap second hand car or reward myself with a holiday! But I bit the bullet and pressed send, panicking temporarily when I realised I hadn’t accounted for the fact that some of that balance was actually my Emergency Fund (oops!). It all worked out though, and I’m no longer worried about it as the remainder is going to be coming out of my cheque account as the regular debit order every month until February, when I’ll increase the limit to reflect any raise I might get. The only hiccup would be if I really don’t get paid over the next few months, in which case I’ll simply call my RA provider and pause my contributions (with no penalty!) until DoH gets its act together.

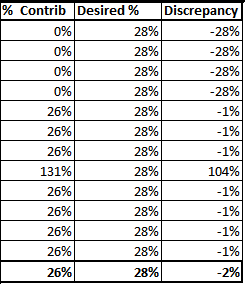

I didn’t quite hit the max allowable contribution (missed it by 2%) because when I set my debit order I had no idea what my actual gross salary because of some issues my Human Resources Department was having with basic math on our payslips. (Have I mentioned before how much HR annoys me at my hospital? I feel like I have.) So an excerpt of my spreadsheet looks like this:

Oopsie! Cut off the months! This table works a bit differently from the last one. The first month is March because that’s the beginning of the tax year, so there are two prior months of 0% contributions not shown. The last two months are again forecasted because obviously we haven’t gotten to January and February of 2017. I based the calculations (elsewhere in the spreadsheet) on the debit order that went through at the beginning of that month (except October when I invested the lump sum I’d saved up, a huge portion of which was my tax refund from August) and the paycheque that entered at the end of the month since, tax-wise, that’s what SARS would look at and I’m using another part of this spreadsheet to forecast my expected tax refund.

The numbers are also rounded by excel, so the 2% difference is actually a bit less than that because the 28% “target” is actually 27.5% per the new laws. I’m not too bothered and I intend to leave my contributions as is.

Nothing to cry over for this goal. - I committed to being generous.

Eish, ja. I’m still struggling with the balance card on this one. There are a few factors that make it difficult, but I won’t rehash those here since I’ve discussed them ad nauseum. What I will say is that I’m experiencing a bit of a paradigm shift when it comes to the little thing we call Black Tax. I always feel I should be giving more to relatives and then I turn around and lament that people were coping before I earned a salary, so it’s curious that I should now need to subsidize their lifestyles, then I feel an overwhelming shame and guilt for even feeling that way and the cycle just goes on. I’m not anywhere near to having a handle on this one, so it’s the one goal that I’m probably failing dismally at.

Definitely room for introspection. - I committed to living within my means

There’s an ongoing joke among my friends who work in one of my favourite departments that this month is the month someone will force me to go “shopping”. This month, mind you, is every month. (This is different from the rather more myopic view of a colleague that I shared before, where me not spending money equals some personal judgement against her spending money. Whatever.) What escapes them, of course, is the fact that none of my goals are in any shape or form facilitated by me shopping. And I’m not just talking about financial goals, because life is bigger than that. I’m talking about personal goals. I’m talking about the keyboard I want to buy so I can start composing without having to scout for the nearest, often out-of-tune, piano. This entails spending money, but not frivolously buying stuff every month just because. Mind you, I only say “frivolous” because it’s not in line with my personal requirements for happiness. Another friend of mine (who was in medical school with me) is a budding designer and entrepreneur, and also has political aspirations. She would glean quite a lot of value from ‘shopping’. And she’d enjoy it. So frivilosity (that’s a word, right?) is relative. Knowing this has allowed me to ‘say yes’ to the things I want, even if that looks like ‘saying no’ according to other people’s tastes. Works for me.

Also, dat spreadsheet doh.

Nothing to cry over for this goal. - I committed to maximising my tax return.

This year I filed my own taxes, which was daunting but so empowering. To be fair though, my tax situation was relatively straightforward as I had very little student income for the 2015 portion, no retirement contributions, no investments and no medical aid (!) for the 2015/2016 tax year which ended in February. Since March, a lot has changed! I’m looking forward to a great tax refund from a combination of factors including refunds from my retirement contributions and the credit from my fairly basic hospital plan premiums. My savings haven’t generated nearly enough interest to create a taxable event, but I’ll still declare everything of course.

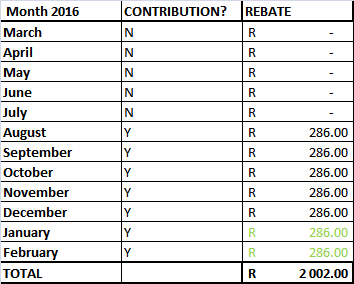

Just as a fun excercise, I calculated what portion of my taxable income will be reduced by the new medical credits system:

It’s nothing to sneeze at for sure, but I think it’s silly how people often act like this is such a huge tax break and that’s why they have ridiculously expensive medical aids. It’s really not. It’s a fixed rebate which only increases if you have more dependents, which has minimal impact since those dependants actually need to be covered.

It’s nothing to sneeze at for sure, but I think it’s silly how people often act like this is such a huge tax break and that’s why they have ridiculously expensive medical aids. It’s really not. It’s a fixed rebate which only increases if you have more dependents, which has minimal impact since those dependants actually need to be covered.

I’m considering adding an ageing relative to my cover next year, so my credit will be higher but so will my expenses. It’s certainly not a free lunch.

Nothing to cry over for this goal. - I committed to maxing out my TFSA

This one has been the scary big bad wolf. Aside from my paltry emergency fund, the money I’ve set aside for my 2016/2017 Tax Free Savings Account allowance is the only money I’ve managed to really save outside of retirement contributions. If I hadn’t been digging myself out of a negative net worth, things might have looked a little different. It took a lot of discipline to save this money and when I hit the amount and was finally ready to invest it, I was overtaken by analysis paralysis.

Has this ever happened to anyone else? (There are billions of people in the world…it must have.) I just feel like this is the only real “discretionary” savings that I have and I don’t want to make any stupid decisions with it. I’ve been educating myself on investing throughout the year, so I know that my best bet for this money since I’ll be leaving it alone for years, is to invest in the stock market. I also know I should go with index funds since I’m simply not interested in the work required to become a value investor or a stock-picker and I know that eight out of ten active managers will be unable to beat the index long term. However, my reading has been so extensive that it’s actually confused me a little bit. Should I invest in ETF or unit trust index funds? What the heck is a bid offer spread and why can nobody explain why I should care about that if I’m planning to hold long term instead of trading? If an index is self-cleansing, and losers drop out when they no longer qualify, am I not essentially buying high and selling low within the index? How am I supposed to decide how to balance my local and offshore exposure, and are offshore funds listed on the JSE and held in Rands really offshore? If so, why do people move their money overseas to invest offshore? What is with the Top 40 as opposed to the ALSI being the most popular local index to track? Isn’t that a ridiculously concentrated amount of risk???

This stuff is seriously giving me headaches and I only have two more months to deploy funds to my TFSA before I lose that space for the year!

Definitely room for introspection Aaaaaaand DASSIT!

These are, of course, really great problems to have. I’m aware of how priveleged I am to worry about something as trivial as bid offer spread (Is it trivial??? Can someone explain what the heck it is?! Google is failing me.) when just over a year ago I didn’t have money for healthy food during exams (true story, I ate boiled spaghetti and apples for weeks) and I was worried that I wouldn’t even be able to graduate since I owed so much money to the University. I recognise how fortunate I am to be getting paid well to do work I love, and I want to make as many good decisions as possible so that I’m not looking back years from now regretting wasted opportunities and hoping my children can support me in my old age.

What financial goals did you manage to reach in 2016 so far, or are you still hoping to reach before the end of the calender/financial year? Are you comfortable with investing your discretionary savings? Do you know why I should care about bid offer spread, or if at all?

*Don’t know if I’ve said this before, but it bares repeating. I have no financial affiliation with 22seven. It’s just a great app that’s made my financial life so much easier. I’m sure there are equivalent apps provided by specific banks, but I love this one.

Ok, you might be beating yourself up here too much. From the posts I’ve read thus far, you are doing a FANTASTIC JOB! Getting debt free and investing that money in your retirement accounts is amazing. Pat yourself on the back for a job well done in 2016. Good luck in 2017! I’ll be following along!

LikeLike

Thanks for popping by with such positive thoughts! I guess I’m just really Type A, if I don’t meet a goal I have to analyse the “whys” to death. Here’s to a successful (and maybe less self-critical) 2017!

LikeLike